THE $34-BILLION ANNUAL U.S. NAVY MARKET

An Update On U.S. Navy Spending For Ships And Equipment In FY1989 The U.S. Navy continues to be the driving force for shipyards and many equipment manufacturers.

Spending for ships, weapons, support equipment and maintenance exceeds $34 billion annually.

Ship Procurement The Navy has requested funds to build 17 ships and lengthen two fleet oilers in Fiscal Year 1989. A budget of $9.1 billion for ship procurement is proposed. Details for the ship procurement budget for FY 1988 to 1992 are shown in Exhibit 1.

Some changes from last year include a more than 14 percent cut from the fast combat support ship (AOE) budget. The Navy had planned to budget $425.4 million for the AOE program—but reduced the funding level to $363.9 million in this year's budget request. The TACS crane ship conversion planned for FY 1989 was dropped due to budget pressures. Funds for strategic sealift were also dropped—largely as a reaction to a hotly contested decision which transferred control over the Ready Reserve Fleet (RRF) from the Navy to the Maritime Administration.

In early April, the House Armed Services Committee recommended the Navy ship program be approved— with the exception of the proposed oceanographic ship. The Navy has asked for $74 million to build one SWATH-design AGOR research ship. The committee recommended against this funding on the basis the design was not fully developed.

The Senate Armed Services Committee bill completed mark up in late April— and the Senate bill essentially similar to the House version.

Both the House and the Senate must act on the Committees' authorization bill recommendations. Each chamber will vote on an authorization bill. Differences between the two bills will be negotiated by House/Senate conferees. A compromise final version will be sent to the President for signature. An appropriations bill must also be passed by each chamber, providing funding for ship and other defense procurements.

A compromise appropriations bill must then be agreed to by House/Senate conferees. Both the authorization bill and appropriations bill must be passed before the FY 1989 program is finalized.

The House Armed Services Committee has recommended the addition of one Army logistics support vessel (LSV) in the FY 1989 program.

Four of these ships are under contract to Moss Point Marine, a member of the Trinity Industries' shipbuilding group. The Army has indicated that a fifth vessel is required.

In late March, Newport News Shipbuilding, Newport News, Va., received a contract to begin pruchasing long lead items for the aircraft carriers CVN-74 and -75. Two carriers, the USS Abraham Lincoln (CVN-72) and the USS George Washington (CVN-73) are currently under construction at Newport News. This new contract gives an unprecedented backlog of four nuclear carriers.

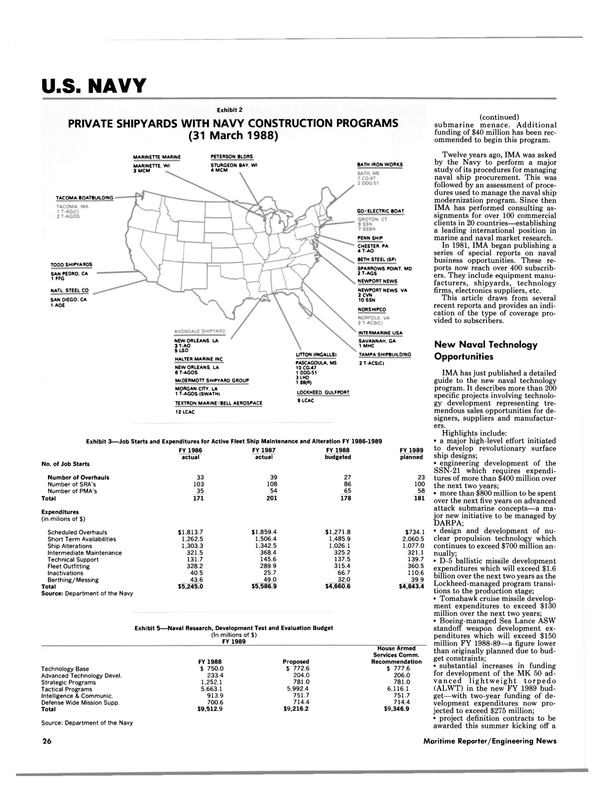

In other ship programs, more than 90 Navy ships are under construction at U.S. shipyards. Full details are provided in Exhibit 2.

Weapons & Support Equipment A total of $11.1 billion has been requested in FY 1989 to buy missiles, torpedoes, electronics and other support equipment. This is an increase of $600 million over FY 1988.

Ship Maintenance Budget Maintenance and modernization of naval ships continues to drive work in U.S. ship-repair yards.

Spending for ship repair is projected to be $4.8 billion in FY 1989.

From FY 1983 through FY 1987, there has been a clear decline in the number of overhauls—while the number of short term availabilities has increased significantly. In FY 1988, the number of both overhauls and SRAs/PMAs is expected to decline.

In FY 1989, SRA/PMA job starts are projected to increase somewhat over this year.

Funding constraints are now obviously affecting Navy ship maintenance.

A year ago the Navy planned to spend more than $5 billion to perform 215 scheduled maintenance job starts in FY 1988. The most recent plan for FY 1988 calls for expenditures of $4.7 billion to perform 178 scheduled job starts.

Almost $600 million has been cut from the Navy active fleet ship maintenance and modernization plan for FY 1989. Most of the cuts are in the area of ship alterations— where planned spending has been cut from $1.6 billion to under $1.1 billion. The trend toward fewer overhauls and more short term scheduled availabilities continues.

Details are shown in Exhibit 3.

N e w Technology Development Funding totaling $9.2 billion has been requested for research and engineering in FY 1989. This figure is slightly lower than FY 1988. Details for recent years are shown in Exhibit 5.

Budget pressures have forced the Navy to cut back on proposed research and development spending in FY 1989. A year ago, the Navy planned to budget slightly more than $10 billion for this activity in FY 1989. The figure has been cut 8 percent to $9.2 billion. This is still double the spending level of 10 years ago.

Expanding DARPA Role In Navy R&D The House Armed Services Committee reaffirmed that the Defense Advanced Research Projects Agency (DARPA) should manage the advanced submarine technology program.

This program is intended to identify and develop revolutionary submarine hull and nonnuclear propulsion technologies. DARPA's responsibility will continue over the next three to five years—with total funding exceeding $800 million anticipated for the work.

The Committee also assigned responsibility to DARPA to begin development of an advanced torpedo.

Additional funding of $10 million is recommended for FY 1989 to begin this program.

Another responsibility assigned to DARPA is the antisubmarine warfare initiative. This is to be a major integrated technology effort to "come to grips" with the Soviet submarine menace. Additional funding of $40 million has been recommended to begin this program.

Twelve years ago, IMA was asked by the Navy to perform a major study of its procedures for managing naval ship procurement. This was followed by an assessment of procedures used to manage the naval ship modernization program. Since then IMA has performed consulting assignments for over 100 commercial clients in 20 countries—establishing a leading international position in marine and naval market research.

In 1981, IMA began publishing a series of special reports on naval business opportunities. These reports now reach over 400 subscribers.

They include equipment manufacturers, shipyards, technology firms, electronics suppliers, etc.

This article draws from several recent r e p o r t s and provides an indication of the type of coverage provided to subscribers.

New Naval Technology Opportunities IMA has just published a detailed guide to the new naval technology program. It describes more than 200 specific projects involving technology development representing tremendous sales opportunities for designers, suppliers and manufacturers.

Highlights include: • a major high-level effort initiated to develop revolutionary surface ship designs; • engineering development of the SSN-21 which requires expenditures of more than $400 million over the next two years; • more than $800 million to be spent over the next five years on advanced attack submarine concepts—a major new initiative to be managed by DARPA; • design and development of nuclear propulsion technology which continues to exceed $700 million annually; • D-5 ballistic missile development expenditures which will exceed $1.6 billion over the next two years as the Lockheed-managed program transitions to the production stage; • Tomahawk cruise missile development expenditures to exceed $130 million over the next two years; • Boeing-managed Sea Lance ASW standoff weapon development expenditures which will exceed $150 million FY 1988-89—a figure lower than originally planned due to budget constraints; • substantial increases in funding for development of the MK 50 advanced lightweight torpedo (ALWT) in the new FY 1989 budget— with two-year funding of development expenditures now projected to exceed $275 million; • project definition contracts to be awarded this summer kicking off a 30-month design and engineering phase for the new generation mine; • expenditures over the next two years for Aegis engineering and development to exceed $350 million; • more than $118 million earmarked in FY 1988-89 for surface ship ASW system development and engineering; • development and engineering of submarine sonar systems projected to exceed $275 million over the next two years; • full scale engineering to develop and deliver 28 AN/BSY(2) submarine combat systems—a $7.3 billion long-term development and procurement program for the Seawolf submarine; • expenditures to develop the Fixed Distributed System (FDS)—a key component of future offboard ASW surveillance—totaling $170 million in FY 1988-89; • more than $97 million over the next two years to be spent on developing advanced submarine communications systems; and • almost $87 million to be available in FY 1988-89 for developing new manufacturing technology.

Read THE $34-BILLION ANNUAL U.S. NAVY MARKET in Pdf, Flash or Html5 edition of June 1988 Maritime Reporter

Other stories from June 1988 issue

Content

- Castrol Offers Free 56-Page Lube Oil Guide & World Service Directory page: 6

- ODECO's Hugh J. Kelly Elected Chairman Of NOIA At 16th Annual Meeting page: 7

- $4.3 Million To Peterson Builders To Administer Navy Parts Acquisition page: 8

- John Kristen Joins Ingram Barge Company page: 10

- Service Marine Christens 600-Passenger Paddlewheeler For Heritage Cruise Lines page: 10

- World's Largest Railway/Freight Ferry Launched By Seebeckwerft page: 11

- NASSCO Announces Production Management Realignment page: 11

- SPD Technologies Negotiating To Acquire Navy Division Of Brown Boveri Power Equipment Inc. page: 11

- Munson Manufacturing Launches Alaskan Excursion Boat For Holland America-Westours page: 12

- MSC Awards Contracts Totaling $154.2 Million page: 14

- 1,000th Golar Marine Incinerator To Be Installed page: 14

- Skuld Undergoes Major Changes In Structure page: 15

- Report 'Genesis System' Can Produce Record Fuel Savings For Vessel Owners page: 16

- Bailey Controls Completes Installation Of N e w Flow Calibration Laboratory page: 16

- Houma Fabricators A w a r d e d Contract For Vehicle-Passenger Ferry page: 17

- Brochure Available On N e w Sound Absorption Material From Soundcoat page: 18

- John M. Stebbins Named VP, Sales And Marketing Of Alco Power Inc. page: 18

- Gladding-Hearn Receives Order For INCAT-Design Passenger Ferry For N e w York Commuter Service page: 20

- SPD Technologies Names Biancamano Manager, International Marketing page: 20

- Intertek Offers Free Eight-Page Full-Color Brochure On Services page: 21

- Blount Christens 'Spirit Of Chicago' —7th Luxury Dinner Vessel In 'Spirit' Line For Cruise International page: 22

- Marathon LeTourneau Introduces New GulfKing Class Jackup For Gulf Of Mexico page: 23

- THE $34-BILLION ANNUAL U.S. NAVY MARKET page: 24

- SHIPBUILDING AND REPAIR IN U.S. SHIPYARDS page: 40

- The Tug And Barge Industry Provides A Wealth Of Benefits To American Consumers page: 44

- BARGE INDUSTRY WAITS FOR CONGRESSIONAL ACTION ON HIGHWAY DIESEL TAX page: 44

- REVIEW AND OUTLOOK page: 62

- World Shipbuilding page: 64

- Cummins-Powered Paddlewheeler Delivered By Superior Boat Works page: 76

- Leslie Controls Announces DLO-1 Series 80 Valves page: 77

- Aeroquip Offers Hydraulic Troubleshooting Bulletin page: 77

- HDW Christens Two Containerships For American President Lines page: 78

- Bender Shipbuilding Delivers Fish Processing Vessel 'Seattle Enterprise' page: 78

- DEFCO Offers Free Literature On Diesel Products And Services page: 79

- Waugh Offers Literature On Head Modules And TNF Joiner Systems page: 79

- Electrocatalytic Acquires DEM Cell Technology page: 80

- McElroy Offers Free 47-Page Brochure On Deck Machinery page: 80

- Indicator Switch From Nupro Connects To Air Actuated Bellows Valves page: 81

- Spare Parts Amendment Passes House page: 81

- Shipyard 'Pride Program' Instituted At PSRY page: 82

- Ward Offers Brochure On Manufacture Of Marine Components page: 82

- Conrad Industries Delivers 650-Ton-Capacity Drydock To French West Indies page: 83

- Sensitive Regulator From Circle Seal Assures Accuracy For Corrosive Or Ultra-Pure Fluids page: 84

- Watercom Offers Extra Convenience Of Fax Machine Message Transmission page: 84

- Simrad Receives Canadian Contract page: 85

- Houston Ship Repair Busy With Work page: 86

- Stewart & Stevenson Expands Diesel Engine Sales/Service Network page: 88

- Sperry Marine Awarded Submarine Navigation Radar Contract page: 89

- Rexroth Introduces N ew Hydraulic Radial Piston Motor page: 89

- Trimble Introduces NavGraphic Loran Track Plotter, And New Digital Version Of 10X Loran page: 90

- Conrad Industries Sees Signs Of Optimism In Offshore Industry page: 90

- SPD Technologies Names Larry Colangelo Senior VP page: 91

- Moss Point Marine Delivers Second Of Four Army Landing Craft page: 92

- Bath Iron Works Launches Guided Missile Cruiser 'Normandy' page: 92

- PetroCom Completes First C e l l u l a r / S a t e l l i te Phone Service in Gulf Of Mexico page: 93

- Joseph Le Blanc Jr. Retires From Trinity Marine Group page: 93

- Derecktor Shipyard Lays Keel For First Of Two Tugboats For U.S. Army page: 94

- Wartsila Diesel Presents Paper At ASTM Symposium page: 94

- Hyde Offers Independent Power Unit Systems To Meet SOLAS Requirements page: 95

- SKF Introduces Keyless Bushing; Will Market Nilos Rings In U.S. page: 95

- McDermott Shipyard Delivers 1,475-Passenger Ferry page: 96

- M o n A r k ' s Workboat Division Delivers 28-Foot Patrol Boat page: 97

- Raytheon Marketing New Electromagnetic Speedlog Series page: 98

- Call For Papers For American Welding Society's 70th Annual Convention page: 99

- COMSAT A n d MCI Sign Interconnection Agreement page: 100

- N e w 138-Page Level And Flow Sensor Catalog O f f e r e d Free By GEMS page: 100

- Gems Offers 24-Page Catalog Featuring Continuous Liquid Level Indicating Systems page: 110

- Crew And Supply Boat Conversion Can Be A Profitable Venture page: 113

- Tom Bunyan, Inventor Of 'Pilgrim' Products Marketed By Mapeco, Honored By Queen Elizabeth page: 114

- Comsat Announces SafetyNet Service For Ships At Sea page: 115

- N e w Class DBOY-2 Valve Line N o w Available From Leslie Controls, Ltd. page: 115