Gas Turbines

-

- Talking Turbines with Bolsinger, VP at GE Marine Maritime Reporter, Nov 2014 #134

As the commercial marine market faces increasingly stringent propulsion system emission restrictions and fuel cost pressures, propulsion technologies such as gas turbines can gain traction in more mainstream commercial applications. Maritime Reporter & Engineering News recently spent some time with Brien Bolsinger, GE Marine’s VP of Marine, for insights from this traditional gas turbine power.

As GE is mammoth, can you concisely explain the products and services that GE Marine offers to the global marine market?

We sell complete propulsion systems for diverse ship applications in both the commercial and naval marine markets. GE Marine is one of the world’s leading manufacturers of aeroderivative marine gas turbines, ranging from 4.5 to 52 MW. Our gas turbines are excellent prime movers for mechanical drive, hybrid, or all electric propulsion systems. On the commercial front, our gas turbines are used in oil & gas for floating production, storage and offloading vessels, as well as on platforms. Our units are on passenger ships of various types: cruise ships, fast ferries and yachts. In the future, we see gas turbines bringing advantages to LNG carriers, too. From a naval perspective, we have a fleet of marine gas turbines powering various military ships, ranging from patrol boats on the small side, to aircraft carriers and may other ship classes in between. Our engines power ships in 33 navies around the globe and have garnered more than 13 million operating hours. But we are more than an equipment supplier. We offer complete service capabilities through our own overhaul facility, as well as through a network of authorized service providers.Shipowners today – commercial and naval – are faced with new rules regarding emissions, and perpetually battle the fuel cost issue. How are these and other drivers affecting the use of gas turbines to power new commercial vessels?

Key market drivers remain tightening of worldwide emissions regulations as well as fuel pricing. New IMO guidelines will require lowering of SOx emissions by January 1, 2020. In concert, we anticipate the price gap to shrink between Marine Gas Oil and low sulfur diesel fuel, thus improving gas turbine economics. We also are seeing an extraordinary global build-out of the LNG infrastructure to support widespread use of this clean-burning and least expensive fuel in the marine industry.

Our turbines are fuel-flexible, capable of burning diverse fuels including LNG. All the while, GE gas turbines can meet stringent environmental emissions regulations, especially when equipped with our Dry Low NOx emissions (DLE) combustion system. This optional technology can meet Tier III IMO/Tier IV United States Environmental Protection Agency requirements now operating on gas or liquid fuel, with no exhaust treatment and no methane slip.

And the power density of our gas turbines – meaning their high power in a light weight, small footprint – offers room for more cargo or passengers. Simply stated this means GE’s gas turbine-based systems bring value to operators of nearly any commercial ship requiring 4 MW or more in power.

We know that GE Marine is a ubiquitous name in world maritime circles, but for the benefit of our readers can you discuss GE’s gas turbine experience in the global commercial marine sector?

We have delivered more than 90 of our marine gas turbines worldwide since 1995 for many commercial applications, including 17 cruise ships, five high speed yachts and 19 fast ferries. All told, the worldwide industrial and marine gas turbine fleet has garnered more than 85 million operating hours, 13 million of which are in marine applications.

A recent pioneering project that relies on GE gas turbines is the fast ferry Francisco. Operated by Buquebus, between Buenos Aires and Montevideo, Francisco is the world’s fastest commercial ship. Francisco began operating in July 2013, powered by two GE’s dual fuel 25 MW gas turbines; the ferry has the ability to operate on both MGO and LNG. These engines power the ship to speeds in excess of 50 knots during normal operation on either gas or liquid fuel. Also, the (compact footprint of the) gas turbines allowed the ferry to incorporate a 11,840-sq. ft. duty-free shop – reportedly the largest shopping area ever installed on a fast ferry.

GE gas turbines (also) blazed a trail in the cruise market; the only gas turbines installed on cruise ships anywhere in the world today.

And we have been in the commercial market for quite some time as demonstrated with the two 4.5 MW GE marine gas turbines that have been operating since 1995 onboard TurboJET’s Foilcat fast ferry. This multihull hydrofoil catamaran, which links Hong Kong to Macau, can carry 423 passengers, with a maximum service speed of 45 knots.

From where you sit, what are some of the operational advantages of gas turbines on commercial ships?

There are many, including:

• Power density: As I mentioned, one of the most obvious benefits of using our gas turbines is their size and weight advantages. This power density offers flexibility as to where you can place the propulsion system onboard the ship, requiring reduced structural steel to support the system within the ship, and freeing up more revenue-generating payload space. A perfect example is on cruise ships, where the gas turbines have been placed inside the funnel at the top of the ship, opening up space for an additional 45 state rooms in the hull below.

• Low NOx emissions: With our dual fuel DLE combustion system, GE gas turbines in a combined cycle operation meet even the most stringent pending 2016 levels when burning either (MGO or natural gas fuels, without exhaust after treatment. To date, we have manufactured 880 DLE systems for our aeroderivative gas turbines for industrial applications.

• Fuel Diversity: Our gas turbines offer fuel flexibility by being able to operate on various fuels including MGO, biodiesel, bio-synthetic paraffinic kerosene blends and natural gas. Fuel flexibility is even more beneficial today as commercial ship operators adopt dual-fuel operating scenarios to meet new emissions regulations. Dual fuel gas turbines operate in gas fuel mode (without liquid pilot fuel), or liquid fuel mode, and change between modes at any power level within 30 seconds.

• Reduced maintenance costs: We follow an “on condition” maintenance philosophy. This means that engine overhaul is not time-limited, but arranged when necessary as revealed during a regularly scheduled inspection. Even while operating at full power, 100% of the time, combustor and hot section repair intervals can stretch to 25,000 hours when burning natural gas.

• Increased availability: This maintenance philosophy yields increased availability of the vessel. When an engine overhaul is required, the gas turbine is removed and replaced by a spare unit, usually within 24 hours. Overhaul is not performed in-place (onboard the ship), but under shop conditions at a land-based depot facility.

What are the most popular ship configurations to use GE gas turbines?

Since propulsion architecture is based on the power required, the duty cycle, environmental concerns and many other factors, these are the most popular cycles used for ship propulsion:

• Combined gas turbine system mechanical drive - driving propellers (COGAG)

• Combined gas turbine and diesel mechanical drive (CODAG)

• Combined gas turbine or diesel mechanical drive (CODOG)

• Hybrid drive options: combined diesel electric or gas turbine (CODOG)

• Combined gas turbine, electric and steam system (COGES) for electric drive

We recently signed a MOU with Lloyd’s Register to identify potential gas turbine-powered commercial ship projects. This allows GE and Lloyd’s Register to work with shipyards to approve in principle GE gas turbine-powered commercial vessels for global customers. Separately, GE is teaming with Dalian Shipbuilding Industry Company and Lloyd’s Register to jointly develop a design for a gas turbine-powered LNG carrier.

Are there any other noteworthy,new technologies is GE Marine pursuing that would have application in the marine market?

GE teamed with Echogen Power Systems to provide Echogen’s exhaust heat-to-power products using CO2 in a closed loop configuration. These products enhance GE’s mechanical, hybrid and all-electric propulsion system solutions, boosting efficiency by capturing the heat inherent in the gas turbine or diesel engine exhaust stream and turning it into electricity. Echogen’s system allows for a more compact, lighter and economical configuration than traditional steam systems. Converting energy that traditionally gets exhausted into useful power allows the overall system thermal efficiency to increase to near 50%.(As published in the November 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)

-

- GE's M a r i n e Gas Turbine Family Expanding To Satisfy The Markets Maritime Reporter, Apr 1989 #82

aboard the U.S. Navy's USS Spruance (DD-963). Since that time, the LM 2500 has been selected by 17 other navies, GE has introduced other marine gas turbines, and the served market for GE's engines has continued to expand every year. The shift to marine gas turbines for surface combatants for all

-

- Free 14-Page Booklet On Gas Turbine Controls Offered By Woodward Maritime Reporter, Oct 15, 1985 #8

a 14-page booklet on their extensive line of mechanicalhydraulic governors, electronic controls, actuators, and metering valves commonly applied to gas turbines. The publication is divided into seven separate sections: Mechanical- Hydraulic Governors for Industrial Gas Turbines; Electronic Controls for

-

- Vericor Is A Reliable Source of Propulsion Power Maritime Reporter, Apr 2002 #35

company of Honeywell International, Inc. and MTU Aero Engines GmbH offers commercial ship operators and navies alike its TF series aeroderivative gas turbines, which are adapted from Honeywell's proven aero-engine designs and specifically configured for marine use. Currently there are more than 500 TF

-

- GE Continues To Set Gas Turbine Tech Pace Maritime Reporter, Apr 2002 #34

GE Marine Engines has seen its LM aeroderivative gas turbines selected by 28 navies throughout the world. Recently GE announced the selection of its LM2500 aeroderivative gas turbines and main reduction gears for use aboard the Italian Navy's new Andrea Doria aircraft carrier. The aircraft carrier is

-

- ASME Marine Committee To Present Thirteen Papers At Zurich Gas Turbine Conference Maritime Reporter, Mar 1974 #34

Conference in Zurich between March 30 and April 4, 1974. This program consists of 13 interesting and timely papers as well as a Forum on Marine Gas Turbines. The marine program is as follows: April 1, Morning Session—Subject: "Installation, Application and Maintenance of Marine Gas Turbines"; chairman

-

- Gas Turbines Continue Making Commercial Inroads Maritime Reporter, Mar 2002 #44

propulsion systems for a variety of commercial and military marine customers for more than 25 years. GE's complete line of aeroderivative gas turbines includes the LM500 (6,000 hp). LM1600 (20.000 hp), the LM2500 (33,600 hp), the LM2500+ (40,500 hp) and the LM6000 (57,330 hp). For instance

-

- Gas Turbines: Keeping Fresh With Innovation Maritime Reporter, May 2004 #32

the fast-evolving maritime industry is a mantra at GE Marine with its LM aeroderivative gas turbine line. Going forward, GE Marine will see its LM gas turbines applied in several novel and state-of-the-art military and commercial marine projects. One military application in particular — the Office of

-

- Millennium's Vibration Problem Not Related To Gas Turbines Maritime Reporter, Oct 2000 #50

best describe the inauguration of Celebrity's Millennium, which occurred in England this past summer. Ironically, the splashing part of the gas turbine-powered vessel's debut is what is now causing headaches at the Miami, Fla.-based company. It seems that the slapping of the water against

-

- MarAd Releases 15 Technical Reports On Gas Turbines Maritime Reporter, Oct 15, 1977 #42

The Maritime Administration has released a group of 15 technical reports evaluating the feasibility of heavy-duty gas turbines as a competitive and acceptable form of marine propulsion generation. The reports were prepared under a contract awarded in 1970 to the General Electric Company, Gas

-

- DeLaval IMO Pump Division Publishes Illustrated Bulletin On Pumps For Gas Turbines Maritime Reporter, Apr 1976 #48

The IMO Pump Division of DeLaval Turbine Inc. has just published a six-page illustrated bulletin on IMO fuel and lube pumps for use with gas turbines. The bulletin gives specification and performance parameters for fuel injection, fuel transfer and lube applications. IMO pumps can operate on

-

- N.Y. SNAME, NYPE, IME And ASNE Joint Meeting Hears Paper On Silencing Marine Gas Turbines Maritime Reporter, Jan 15, 1974 #27

. After a social hour and dinner, the technical session was held at which a paper was presented entitled "Case Histories of the Silencing of Marine Gas Turbines," by Morton I. Schiff, vice president, Industrial Acoustics Company, Inc. The author states that while techniques for silencing gas turbines have

-

)

March 2024 - Marine Technology Reporter page: 37

)

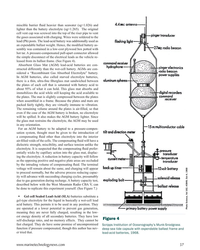

March 2024 - Marine Technology Reporter page: 37(sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionally used as an expendable ballast weight

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36battery packs, di- If sealed with a rubber diaphragm, the battery must be vent- vided into three buses. The sub could operate off a single ed to manage gases formed during charging. (Myers, 1968) bus in emergency mode. All power and control signals were An innovative means of pressure compensation was

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25SYSTEM just mapped. I have ‘discovered’ many mountains, hills, valleys and canyons that APPLICATIONS would rival anything seen on land.” • Shallow Gas Hazard Surveys • Oi shore Wind Turbine Phase two, mapping inside the caldera, • Geotechnical InvesO gaO on • Sand Resource InvesO gaO

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42indicator (CII) meeting the shipping industry’s goal for id advances in digital technology are and EU Emissions Trading Scheme are net-zero greenhouse gas emissions by changing the way ships are operated. only early milestones on the regulatory around 2050. He also believes maritime “The maritime education

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38Consulmar Crowley's New LNG Containerships Carbon Capture @ Sea Crowley shared ? rst renderings and the names of its four new dual fuel lique? ed natural gas (LNG)-powered containerships: Quetzal, Copan, Tiscapa and Torogoz. The 1,400 TEU ves- sels were ordered in 2022 by Singapore-based Eastern Paci? c

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35environment, which in turn can from vessel drawings. The academy program also includes reduce the time they need to spend on a simulator. This saves gas handling operations and engine room simulation courses time and money and frees up simulator time for others. offered by GTT Training and the Thet

-

)

April 2024 - Maritime Reporter and Engineering News page: 33

)

April 2024 - Maritime Reporter and Engineering News page: 33CRANES & OFFSHORE WIND HLP is developing a crane that will enable tower HLP is developing a crane that will enable pieces to be stacked components such as towers to be stacked in multiple layers on vertically in marshalling areas. installation vessels. HLP is developing a ring crane capable of 6

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32wind. The subsidies won’t be a plentiful, and then a second on a luf? ng jib. This reduces the time it would there won’t be the same downturn in oil and gas that made all ordinarily take, weeks, to recon? gure the wiring of an ordi- the high-spec construction vessels available at attractive rates, nary

-

)

April 2024 - Maritime Reporter and Engineering News page: 31

)

April 2024 - Maritime Reporter and Engineering News page: 31CRANES & OFFSHORE WIND Cadeler’s new NG-20000X class vessels will have 2,600t cranes, and its new NG-20000F class vessel will have a 3,200t crane. Similar new vessels for Havfram will have a crane of approximately 3,200t, as will Van Oord’s KNUD E. HAN- SEN-designed newbuilding currently being built in

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25or older and need to be that are government owned and operated ships, government replaced. We’re talking all the way from steam to diesel and some gas turbines. The commercial world doesn’t use owned and contract operated, and contract owned and con- steam any more, but we still have quite a few steam-pow- trac

-

)

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22INTERVIEW WE ARE ENGAGED WITH MULTIPLE US OSW WIND DEVELOPMENTS AND SEEING AN UP-TICK FOR CVA, TECHNOLOGY REVIEW AND RISK REDUCTION SERVICES IN EARLY DEVELOPMENT PHASES. WITH NEW LEASE ROUNDS COMING AND NEW OPPORTUNITIES, WE DO NOT SEE A BIG SLOWDOWN FOR OSW DEVELOPMENTS APART FROM THE OBVIOUS

-

)

April 2024 - Maritime Reporter and Engineering News page: 21

)

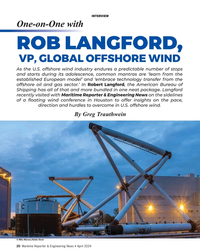

April 2024 - Maritime Reporter and Engineering News page: 21with our continued support to the in a UK design ? rm working in the North Sea marine industry,” said Langford. “We continue to hire key in- oil and gas platforms, the holy grail of rigorous dividuals and partner to provide best-in-class solutions.” R conditions in offshore energy production. From

-

)

April 2024 - Maritime Reporter and Engineering News page: 20

)

April 2024 - Maritime Reporter and Engineering News page: 20starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas sector.’ In Robert Langford, the American Bureau of Shipping has all of that and more bundled in one neat package. Langford recently visited with

-

)

April 2024 - Maritime Reporter and Engineering News page: 19

)

April 2024 - Maritime Reporter and Engineering News page: 19exposed to redeployment risk and there re- mains a concern that overbuilding of a commoditized vessel may result in future oversupply as seen in the oil & gas OSV space in the 2008-2014 period. www.marinelink.com 19 MR #4 (18-33).indd 19 4/5/2024 8:13:37 A

-

)

April 2024 - Maritime Reporter and Engineering News page: 18

)

April 2024 - Maritime Reporter and Engineering News page: 18MARKETS & gas activity returns, we anticipate that supply of the vessels The Question of Emissions to offshore wind projects will reduce, driving demand for ad- Given that SOVs and CSOVs operate in a segment target- ditional CSOVs. ing reduced emissions, and many operate in the North Eu- Outside of China

-

)

April 2024 - Maritime Reporter and Engineering News page: 17

)

April 2024 - Maritime Reporter and Engineering News page: 17SOVs China, we do not look at demand for SOVs/CSOVs as having a linear rela- tionship to the number of wind farms or turbines installed. We look to see where a large number of wind turbines are concentrated in relatively close proximity, generally in a very large wind farm or in a project cluster

-

)

April 2024 - Maritime Reporter and Engineering News page: 16

)

April 2024 - Maritime Reporter and Engineering News page: 16to a wind turbine OEM or offshore wind in-built crane and gangway. farm operator to service and maintain equipment dur- ¦Tier 2: Generally, oil & gas tonnage (MPSVs, PSVs, ing the operations period of the wind farm. A typical etc.) with ? xed gangway, serving oil & gas and SOV will accommodate

-

)

April 2024 - Maritime Reporter and Engineering News page: 11

)

April 2024 - Maritime Reporter and Engineering News page: 11culture of continuous improvement and Cooper safety awareness. Captain Aaron Cooper is a Master Mariner with 30 years of experience in the oil and gas industry. He is the programmes A Cultural Shift director at OCIMF. With standardized data collection and sharing protocols, THE LEADER SLIDING

-

)

April 2024 - Maritime Reporter and Engineering News page: 6

)

April 2024 - Maritime Reporter and Engineering News page: 6Editorial MARITIME REPORTER AND ENGINEERING NEWS his month’s coverage is M A R I N E L I N K . C O M almost an afterthought HQ 118 E. 25th St., 2nd Floor following the tragedy that New York, NY 10010 USA T +1.212.477.6700 Tunfolded in Baltimore in the wee hours of Tuesday, March 26, CEO John C.

-

)

April 2024 - Maritime Reporter and Engineering News page: 4

)

April 2024 - Maritime Reporter and Engineering News page: 4Ma- gic planning experience in the ter Mariner with 30 years of expe- rine Learning Systems, maker of energy and maritime sectors. rience in the oil and gas industry. MarineLMS. CONTACT INFORMATION: He is the programs director at Lundquist Email: [email protected] OCIMF. He has worked at Chev- Laursen

-

)

April 2024 - Marine News page: 40

)

April 2024 - Marine News page: 40in the U.S. ? eet. It features four Wabtec 4x16V250MDC EPA Tier 4 marine diesel gensets developing a combined 24,000 horsepower and utilizing exhaust gas recirculation technology to reduce emissions to sub-Tier 4 levels. The General Arnold is 290 feet long, 72 feet wide, has a maximum digging depth

-

)

April 2024 - Marine News page: 36

)

April 2024 - Marine News page: 36and detection technology. Through a lot of hard work and collaboration with part- ners such as the Port of San Diego as well as utility provid- er San Diego Gas & Electric (SDGE), the regulatory and logistical hurdles have been overcome, and construction is progressing at a strong pace, Manzi said. “We expect

-

)

April 2024 - Marine News page: 30

)

April 2024 - Marine News page: 30Feature Shipbuilding Crowley Crowley’s electric tug eWolf, built by Master Boat Builders. Administration (MARAD) put a cost of $97 million on the ulatory ? lings, the vessel “is expected to be delivered and vessel. The same yard has also been contracted to build an operational in 2025.” Filings with

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27our presence in the government marketplace.” In the same panel discussion, Bollinger’s Bordelon said, “You’ve had vessels come out of typical oil and gas markets and maneuver into other markets. This creates conversion opportunities. We’ve probably done over 30 in the last couple of years.” But with