$45-Million Subsidy Repayment Approved

The Maritime Subsidy Board (MSB) has approved the applications of Wilmington Trust Company to repay approximately $45 million in construction-differential subsidies (CDS) which the Maritime Administration previously awarded for the construction of two liquefied natural gas (LNG) vessels. The MSB also granted permission for the two vessels to be employed in the carriage of LNG between Indonesia and Japan.

In addition, the owners would be required to pay interest at the Treasury rate on the subsidy funds expended in construction of the vessels. The interest is estimated to be $2.7 million on one vessel and $2.3 million on the other. The estimated actual cost of the vessels are approximately $104.6 million and $105.4 million, respectively.

These vessels, each with a capacity of 125,000 cubic meters, were part of a three-ship program contracted for in September 1972 with the Quincy, Mass., shipyard of General Dynamics Corp., to be used for the importation of LNG from Algeria to New England and New York.

However, that gas importation project (known as Easco) was canceled earlier this year, resulting in the transfer of these two vessels to the Indonesia-Japan trade.

The repayment of CDS plus interest, which would be deposited in the United States Treasury upon delivery of the vessels, is due to this change in employment of the vessels from U.S. foreign trade to a foreign-to-foreign operation.

The two vessels, as yet unnamed, are tentatively scheduled for delivery in late 1977.

The Wilmington Trust Company is the owner-trustee of both vessels under trust agreements with the equity owners, consisting of subsidiaries of Citibank, N.A., First Chicago Leasing Corporation, and GATX Corporation.

The vessels are bareboat chartered to U.S. citizen operating companies—Summit II and Summit III — and time-chartered to domestic subsidiaries of Burmah Oil Shipping, Inc., a Delaware corporation, which is a subsidiary of Burmah Oil Company, Ltd., a British corporation.

Under the revised agreement, Burmah would use the two vessels under a Transportation Agreement with the Indonesian national energy company, Pertamina, to carry LNG from Indonesia to Japan. These two ships would replace two other LNGs that had been contracted for in April 1976, also to be built by the General Dynamics Quincy shipyard. The contracts for these two vessels would be canceled.

In granting the approvals, the MSB established the additional conditions that the Government retain the right to the design and engineering data for the vessels and that the ships be subject to the purchase and requisition rights of the United States under the same compensation basis as for other vessels constructed under CDS. The vessels would continue to be owned by an American company and operated under the U.S. flag with American crews.

In a companion action, the Assistant Secretary approved an increase in the Title XI guarantees for the two vessels. If CDS were repaid, the maximum Title XI guarantee would increase from 75 percent to 87 y2 percent, as provided by Section 1104 of the Merchant Marine Act of 1936, as amended. Based on redetermined actual costs, including the interest payments, the Title XI guarantees will be about $91.5 million for one ship and $92.2 million for the other.

Read $45-Million Subsidy Repayment Approved in Pdf, Flash or Html5 edition of September 15, 1977 Maritime Reporter

Other stories from September 15, 1977 issue

Content

- Estimated Foreign Cost Of Two LNG Carriers $115.5 Million Each page: 6

- Bethlehem Steel Names G.Y. Marriner Manager San Francisco Yard page: 7

- AMPAC To Build Four Container Feeder Ships At Cost Of $92 Million page: 7

- SNAME New York Section Announces Program For 1977/1978 Season page: 8

- Marathon Manufacturing Adds $61 Million To Drilling Rig Backlog page: 9

- Role Of Ro/Ro Shipping In Dry Cargo Trade page: 12

- Port Of New Orleans Presents Key To City To Egyptian Official page: 13

- Morris Guralnick Associates, Inc. Name Hubert E. Russell page: 14

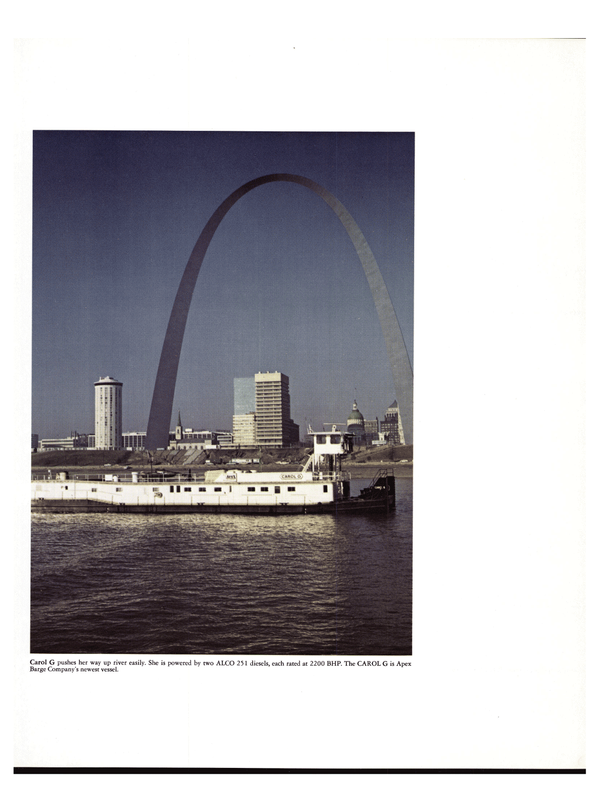

- Hillman-Designed New Class Towboat Delivered To Exxon At Baton Rouge page: 19

- $45-Million Subsidy Repayment Approved page: 23

- Bethlehem Steel Shipbuilding Names Roland V. Danielson —Hollinshead De Luce Retires page: 26

- Perspectives On Third World Port Development page: 30

- Farrell Sale And Leaseback Agreement Approved By MarAd page: 32

- Delta Steamship Names Badger And Collins page: 32

- CCN Of Brazil Launches New Type Bulk Carrier page: 33

- 51st Annual Propeller Club Convention And 1977 American Merchant Marine Conference Set For Galveston, Texas, Oct. 10, 11, 12, 13 And 14 page: 34

- Bulletin Describes Heavy-Duty Oil Filtration Systems page: 35

- Eight-Page Brochure Describes National's Fully Hydraulic Cranes page: 35

- Todd Shipyards Los Angeles Division Lays Keel For First Of Six U.S. Navy Frigates page: 38

- MacGregor Slewing Ramps Successfully Tested page: 39

- Skagit Corporation Announces European Dealership Agreement page: 40

- FMC Marine & Rail Lays Keel For Ro/Ro Barge To Carry 374 Forty-Foot Truck Trailers page: 40

- Egyptian Shipyard Receives License To Build Willard Boats page: 42

- Bergeron Industries Names Captain Tatman page: 42

- Port Authorities (AAPA) 66th Annual Convention Set For Mexico City page: 43

- Tanker Design Change Approved By MSB page: 44

- Mitsubishi Receives Tug Barge Systems' License To Build page: 46

- Norshipco Dedicates New $5-Million Repair Pier page: 47

- Fetzner Named President Sun Trading & Marine page: 48

- Jane's Fighting Ships 1977-78 Revised Edition page: 49

- Stanford Research Awarded $271,000 For Firefighting Study page: 50

- Renegotiation Board Erred In Computing Lockheed Steel Usage page: 51

- Pott Industries Names Miller VP Offshore Marine Services Div. page: 54

- Capt. James F. McNulty New Dean At Maine Maritime Academy page: 56

- Richard Daschbach Named Federal Maritime Commission Chairman page: 57

- Keene Brochure Describes Marine Discharge Control System page: 57