Floating Production Systems: Market Update

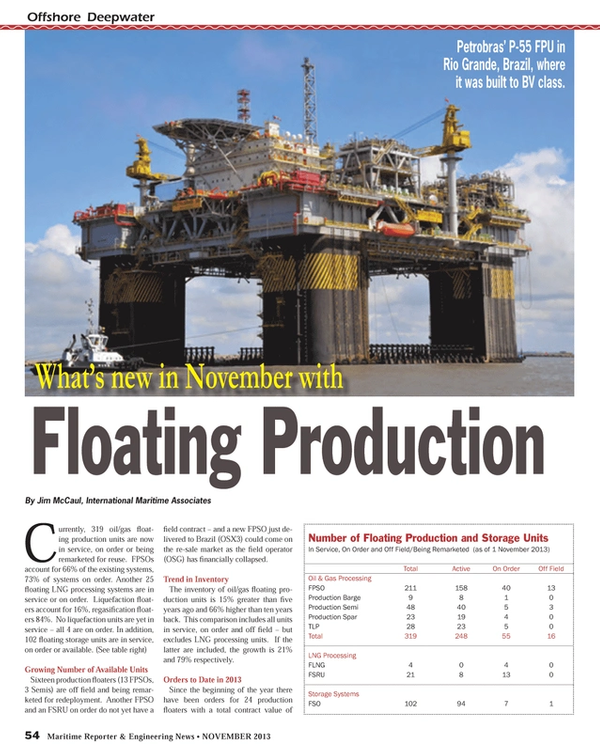

Currently, 319 oil/gas floating production units are now in service, on order or being remarketed for reuse. FPSOs account for 66% of the existing systems, 73% of systems on order. Another 25 floating LNG processing systems are in service or on order. Liquefaction floaters account for 16%, regasification floaters 84%. No liquefaction units are yet in service – all 4 are on order. In addition, 102 floating storage units are in service, on order or available. (See table right)

Growing Number of Available Units

Sixteen production floaters (13 FPSOs, 3 Semis) are off field and being remarketed for redeployment. Another FPSO and an FSRU on order do not yet have a field contract – and a new FPSO just delivered to Brazil (OSX3) could come on the re-sale market as the field operator (OSG) has financially collapsed.

Trend in Inventory

The inventory of oil/gas floating production units is 15% greater than five years ago and 66% higher than ten years back. This comparison includes all units in service, on order and off field – but excludes LNG processing units. If the latter are included, the growth is 21% and 79% respectively.

Orders to Date in 2013

Since the beginning of the year there have been orders for 24 production floaters with a total contract value of ~$19 billion. The orders include 11 FPSOs, 2 TLPs, 1 Spar, 2 Barges (1 oil/gas, 1 LNG), 7 FSRUs and 1 MOPU. Details for orders to date in 2013 are available at www.imastudies.com.

The pace of production floater orders thus far this year has been running above the long term average. Over the past 15 years orders have averaged 1.2 units per month. The order intake pace this year has been averaging 2.4 units per month.

But the market could be hitting resistance. FPSO orders in particular have been relatively weak. Over the past five years an average of 15 FPSOs have been ordered annually. At the moment it looks like this year will not reach this level of orders.

Backlog of planned floater projects – 218 floating production projects are in various stages of planning as of beginning November. As shown below, close to 60% entail use of an FPSO.

Where Planned Projects are Located

Brazil is the major location where future floating production projects are in the planning stage. 22% of visible planned projects are located in Brazil. Several Brazilian projects will require multiple production units. Libra could require 12 production units, Jupiter 6 units, Lula 2+ units. When these large projects are taken into account, Brazil represents almost 30% of visible floating production system orders in the planning stage. A breakdown of planned floating production projects by location is below.

Location of Floating

Production Projects

in the Planning Stage

(as of 1 November 2013)

Project Location # of Projects

Brazil 49

Africa 48

SE Asia 34

No. Europe 20

GOM 18

Aust/NZ 15

Med 11

SW Asia 12

Other 11

Total 218

About IMA & Jim McCaul

IMA provides market analysis and strategic planning advice in the marine and offshore sectors. Over 40 years we have performed more than 350 business consulting assignments for 170+ clients in 40+ countries. We have assisted numerous shipbuilders, ship repair yards and manufacturers in forming a a plan of action to penetrate the offshore market. Our assignments have included advice on acquiring an FPSO contractor, forming an alliance to bid for large FPSO contracts, satisfying local content requirements and targeting unmet requirements through technology development.

Tel: 1 202 333 8501

e: [email protected]

www.imastudies.com

(As published in the November 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

Read Floating Production Systems: Market Update in Pdf, Flash or Html5 edition of November 2013 Maritime Reporter

Other stories from November 2013 issue

Content

- Interview: Dr. Herbert Aly page: 12

- Knowledge is Power page: 16

- ReFRESCO: Understanding & Designing Energy Saving Devices page: 18

- Nontank VRP Regs page: 20

- The Magic Ingredients of a Healthy Safety Culture page: 24

- e-Compliance: Revolutionizing the Efficiency of Compliance for Maritime Regs page: 28

- Pull the Handle Down... page: 30

- Return of the Electric Boat page: 38

- Fast Ferry Gets a New Power Package page: 42

- Cat tackles Tier 3 and Tier 4; Completes Berg Deal page: 44

- Konrad, Cummins Propulsion Package Partnership page: 46

- Scania 13L Inline; 16L V8 for EPA Tier 3 page: 48

- The Switch: New Drive Train Tech page: 48

- John Deere Tier 3 Engine Line Up page: 49

- GE Power Conversion page: 49

- EPA’s Vessel General Permit (VGP) & You page: 50

- Are PAGS the Answer? page: 51

- Don’t Forget: Seawater is a Free EAL page: 51

- Lukoil: Cylinder Oil to Reduce Wear, Consumption page: 52

- Agip Rebrands as Eni Powers Ahead in North America page: 52

- Floating Production Systems: Market Update page: 54

- Offshore Brazil: The Libra Field & Brazil’s Pre-Salt Policy page: 56

- On Ballast Water, Time is Running Out page: 60

- Standardization for Safer Shipping of e-Navigation & Training page: 62

- Apprenticeship Training & Academic Degree: The Pathway to Success page: 64

- The Drawing Board: Innovative OSV Design from the Ground up page: 68

- Product Tanker Hijackings page: 72

- The Trinidad & Tobago Maritime Sector page: 74

- Seatorque Boost for Brazil’s Biggest Superyacht page: 76

- Raytheon Anschütz Launches New Gyro Compass page: 85

- Emsys Upgraded to Measure Mass Emissions Rates page: 85

- Thuraya SatSleeve Transforms iPhone into Satellite Phone page: 85

- Kongsberg Debuts New Drilling Rig and Ship Simulator page: 85

- Martek: “BNWAS Password Protection is Essential” page: 85

- Northrop Grumman Radars for USN page: 85

- Imtech Debuts SeaPilot 76 page: 85

- FORAN in Indonesia page: 85

- Raymarine Autopilot page: 86

- Computer Gaming & Maritime Training page: 86

- Jeppesen Updates VVOS Software page: 86

- Harris CapRock & Carnival Sign Contract page: 86

- Carlisle & Finch SmartVIEW Technology page: 86

- Thomas Gunn Unveils New Digital Chart Management System page: 86

- CM-1000 Series: Smart Fluid Handling Tech page: 87

- Paperless Navigation page: 87

- TNKC Fleet & BASS Software page: 87

- Cobham Touchscreen Navtex page: 87

- GE Dynamic Positioning System page: 87

- Ecospeed Fuel Savings Calculator page: 87

- Boatracs’ BTConnect AIS page: 87

- New Brakes from Wichita Clutch page: 88

- Home Study Programs page: 88

- New PowerShark Tool Eats through Biofouling page: 88

- VIKING Expands Training page: 88

- SUPREME Athmos Zero-Pollution Seal page: 88

- New Inertia-Engaged Turbine Air Starter page: 88