Boxed In

It is impossible to view the global container shipping business without looking at it through the prism of vessel capacity being added to the market. What happens over the next two years will be a direct result of the glut of newbuildings that are flooding into service and wrecking freight rates.

Just consider these numbers. During the first four months of 2013, Alphaliner puts the new containership deliveries at 496,000 TEUs. According to data supplied by PR News Service ComPort, almost 250,000 TEUs of that will be comprised of vessels with a nominal capacity of 10,000 TEUs and up.

The vast majority of these vessels will have to be deployed on the Asia-Europe routes as they are too large to serve the emerging markets and cannot fit through the Panama Canal to cover the all-water route to the U.S. East Coast.

New capacity coming online is offsetting vessels being withdrawn as the shipping lines adjust or “upgrade” their services. For instance, the CES2/AEX 2 service - jointly operated by CSCL, Zim and Evergreen - is pulling out 9,000 TEU of its weekly capacity in June, only to see other services on the route, including the G6 and CKYH, injecting 16,500 TEU into Asia-North Europe.

Scrapping of containerships will not solve the problem, either. Even with scrapping expected to reach a record 450,000 TEUs this year – due to a surge in the axing of 3,000 to 5,000 TEU vessels, Alphaliner says – deliveries could top1.6 million boxes in capacity.

Curiously, the lines appear reluctant to increase the idle ship capacity, despite the impact on load factors and freight rates of the capacity overhang.

Economic models are very clear about the result when too much supply meets too little demand – prices fall. And nowhere has this pricing pressure been felt more keenly than on Asia-Europe where rates have collapsed.

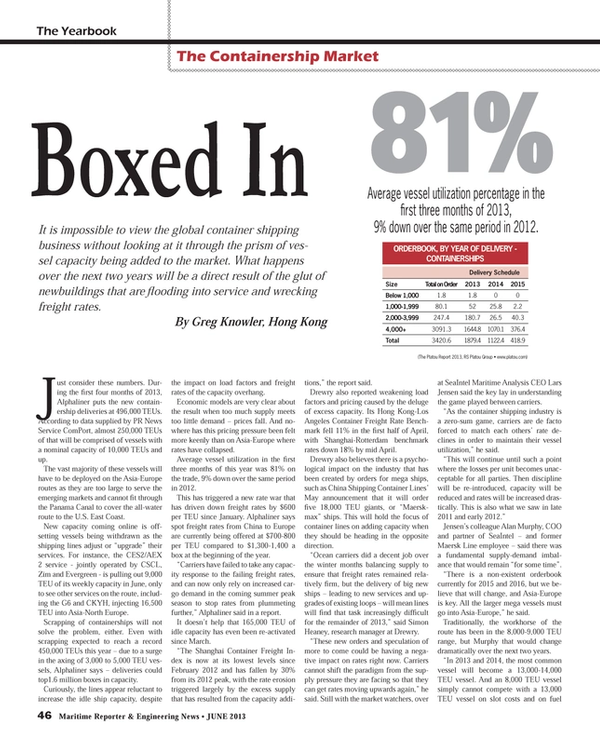

Average vessel utilization in the first three months of this year was 81% on the trade, 9% down over the same period in 2012.

This has triggered a new rate war that has driven down freight rates by $600 per TEU since January. Alphaliner says spot freight rates from China to Europe are currently being offered at $700-800 per TEU compared to $1,300-1,400 a box at the beginning of the year.

“Carriers have failed to take any capacity response to the failing freight rates, and can now only rely on increased cargo demand in the coming summer peak season to stop rates from plummeting further,” Alphaliner said in a report.

It doesn’t help that 165,000 TEU of idle capacity has even been re-activated since March.

“The Shanghai Container Freight Index is now at its lowest levels since February 2012 and has fallen by 30% from its 2012 peak, with the rate erosion triggered largely by the excess supply that has resulted from the capacity additions,” the report said.

Drewry also reported weakening load factors and pricing caused by the deluge of excess capacity. Its Hong Kong-Los Angeles Container Freight Rate Benchmark fell 11% in the first half of April, with Shanghai-Rotterdam benchmark rates down 18% by mid April.

Drewry also believes there is a psychological impact on the industry that has been created by orders for mega ships, such as China Shipping Container Lines’ May announcement that it will order five 18,000 TEU giants, or “Maerskmax” ships. This will hold the focus of container lines on adding capacity when they should be heading in the opposite direction.

“Ocean carriers did a decent job over the winter months balancing supply to ensure that freight rates remained relatively firm, but the delivery of big new ships – leading to new services and upgrades of existing loops – will mean lines will find that task increasingly difficult for the remainder of 2013,” said Simon Heaney, research manager at Drewry.

“These new orders and speculation of more to come could be having a negative impact on rates right now. Carriers cannot shift the paradigm from the supply pressure they are facing so that they can get rates moving upwards again,” he said. Still with the market watchers, over at SeaIntel Maritime Analysis CEO Lars Jensen said the key lay in understanding the game played between carriers.

“As the container shipping industry is a zero-sum game, carriers are de facto forced to match each others’ rate declines in order to maintain their vessel utilization,” he said.

“This will continue until such a point where the losses per unit becomes unacceptable for all parties. Then discipline will be re-introduced, capacity will be reduced and rates will be increased drastically. This is also what we saw in late 2011 and early 2012.”

Jensen’s colleague Alan Murphy, COO and partner of SeaIntel – and former Maersk Line employee – said there was a fundamental supply-demand imbalance that would remain “for some time”.

“There is a non-existent orderbook currently for 2015 and 2016, but we believe that will change, and Asia-Europe is key. All the larger mega vessels must go into Asia-Europe,” he said.

Traditionally, the workhorse of the route has been in the 8,000-9,000 TEU range, but Murphy that would change dramatically over the next two years.

“In 2013 and 2014, the most common vessel will become a 13,000-14,000 TEU vessel. And an 8,000 TEU vessel simply cannot compete with a 13,000 TEU vessel on slot costs and on fuel consumption.”

His message to carriers was blunt. “If you are a carrier stuck with 8,000 TEU vessels on Asia-Europe, you have two options: You buy your own mega vessels or you get out of Asia-Europe.”

However, the introduction of mega vessels has serious supply chain consequences that the carriers have avoided confronting in their determination to cut costs and improve profitability.

Mark Holloway, customer service and APAC supply chain director at food and beverage maker Diageo, said service reliability among the carriers has deteriorated.

“Some 68% of the carriers we use have delivered below the service agreements they have contractually agreed with us. We need that reliability to improve,” he said. Diageo is different to many other shippers on the Asia-Europe trade in that its cargo is shipped from Europe into Asia. This means the company has to put up with extra slow steaming as the ships return to Asia half full or loaded with empties.

“The service reliability against the agreements we have with the carriers is very poor. This means I have to lay down extra inventory because I don’t know when they are going to turn up, or even when they are going to pick the stuff up in Europe,” Holloway complained.

Container lines have been dealing with disgruntled customers for the last couple of decades and have become inured to their complaints. With such high asset costs and a wild profit and loss rise over the last few years, the carriers are far more focused on profitability than customer service.

Stanley Smulders, senior vice-president Asia-Europe and West Africa trade management for Japanese carrier MOL, said having bigger ships was cutting down the number of sailings, and that was having a serious impact on the industry.

“If you have no cargo, you may as well not sail,” he said. “In the old days it never happened because the market was growing all the time. Now it happens more often because we offer more strings, so if you stop the sailings, there are maybe four left.

“There is a reduction of choice and it will continue.”

For shippers, the lack of predictability makes it more difficult to manage inventory and keep shelves full or production lines moving, but the carriers feel there is no alternative to blanking sailings.

“Before, a container would pay for every move it made. The fuel costs and canal costs were considered fixed and the ship would sale anyway,” Smulders said.

“Then the fuel price rose and the cost of fuel took up a bigger share of the operating costs. The rising cost of fuel also came with lower cargo volume and the carriers found it was better to lay up a ship than to sail.”

Hong Kong Shippers’ Council executive director Sunny Ho said he felt sympathy for liner executives, but the influx of newbuildings meant there were too many ships and it was the shippers who were paying for all the excess capacity.

“Many factories have been forced to close or have been forced to move out of China to new regions. But in the liner trade there has not even been one major merger,” Ho said.

This was despite only Maersk Line, OOCL, CMA CGM and Hapag-Lloyd being among the main carriers to finish 2012 in the black.

Murphy agreed that there was a need for consolidation in the industry.

“We predict there will be eight global carriers by 2020,” he said. “There is no industry in the world that can maintain 20 global players at a competitive level.”

The increasing size of ships was also impacting container ports, and global growth and ship size went hand-in-hand, said Mohammed Al Muallem, senior vice-president and managing director of DP World, UAE region. “The emergence of the gateways, the mega ports, has been driven by the arrival of these bigger ships and this is putting pressure on ports and terminal operators. We need to invest in the right places.”

“The trend of big ships is growing. This year we have 18,000 TEUs coming out and who knows what is next. This is all driven by economy of scale and the bottom line. New ships are more efficient and more fuel-efficient, but these big ships are a fact of life and ports need to adjust to this new reality.”

But it is not only ports that need to adjust to this changing world. The new reality is becoming a painful one for both container lines and their customers. The carriers are not prepared to compromise profitability for improved service, and shippers do not like to pay more for falling service levels.

So expect little change in the carrier vs customer world of container shipping and volatility will continue as the lines adopt the mutually exclusive positions of clinging to market share and trying in vain to hike rates while capacity pours into the market.

Carriers have announced hefty new general rates increases for the summer and even a peak season surcharge will be levied on the key trades, but getting them to stick will be no easy task. Despite several rounds of rate increase announcements over the past year, the last time a GRI stuck was in March 2012.

(As published in the June 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

Read Boxed In in Pdf, Flash or Html5 edition of June 2013 Maritime Reporter

Other stories from June 2013 issue

Content

- “Lies, Damned Lies & Statistics” page: 6

- Maersk Rate Hikes Hitting the High Notes page: 8

- Does Svitzer Dominate the Indian Salvage Scene? page: 8

- What You Need to Know to Operate Offshore Brazil page: 10

- Why TWIC? page: 14

- Cargo Morphs in New Directions page: 16

- Annual Economic Sanctions Update page: 18

- Infrastructure for Alaska’s LNG and Other Resources page: 22

- Non-Tankers Next on OPA 90 List page: 26

- Sail Safe BC Ferries’ Safety Initiative page: 30

- Simulation Trends of Tomorrow page: 32

- Economic Impacts of STCW 2010 page: 34

- Breaking Down The Cost of MARPOL page: 36

- The Year in Review page: 40

- Dr. Shashi Kumar page: 44

- Boxed In page: 46

- Contamination Controlled page: 48

- If in Doubt, Ask the Doctor: Is it Time to Buy? page: 52

- Finnish Shipbuilding and Arctic Operations page: 54

- Irving Plans for the Future page: 55

- German Shipbuilding Prospects are Fair & Partly Cloudy page: 58

- Hull Medic: Keep Coats Efficient page: 72

- Diesel-Electric Units Prepared for Navy’s AGOR Project page: 73

- Integrated Bridge Shaping the Future page: 74