Steel, Ship Prices Soar as Tankers Stay Firm

Soaring steel prices are now a major concern for leading shipbuilders.

Uncertainty about spiraling material costs is even causing some yards to defer new orders, market reports indicate.

"The lack of steel in some shipyards of the three major shipbuilding nations is causing newbuildings for 2007 and 2008 to be delayed." says New York tanker broker Poten & Partners in a recent market report. "Some shipyards are not accepting any more ship orders beyond late 2007 or 2008 delivery because of the lack of berth availability, insecurity stemming from the dollar's weakness, as well as uncertain steel cost," the broker says.

China may as well build ships, says Poten, as "they're taking all the steel".

Steel prices have risen by $140 over the last two years, largely on the back of Chinese demand, Poten declares. And.

commenting on current demolition rates, the New York firm explains that "steel needed to build bridges, roads and housing to accommodate the millions of people relocating to China's urban areas from remote rural villages has sent scrap prices above $400 per ldt from the low $l()()s/ldt approx two years ago".

The fact that sophisticated vessels such as LNG carriers and container ships are in heavy demand is further taxing shipyard capacity and new ship prices are rocketing. By way of comparison.

Poten points out that a VLCC cost about $70m to build in 1999. This month, says Poten, the price for a new VLCC has risen to $86m, based on 2007 delivery. However, current VLCC market rates, which averaged W97 last month from the Arabian Gulf to the Far East, equivalent to $61,000 a day, are expected to decline to lower levels, with seasonal change, says Poten. But owners are falling over themselves to get their hands on prompt tonnage. This, says Poten. has meant that modern secondhand VLCCs now cost just about as much as new ones. Owners don't want to wait until 2007/8 - they want new tonnage now. Says Poten: "Suezmaxes, Aframaxes and Panamaxes are seeing the same type of price increases. A Suezmax newbuilding is quoted at just over $57m this month," the broker reports, the highest price in a decade.

Meanwhile Aframaxes are being quoted at up to S47m, up from $36m in April 2000 and Panamaxes prices are around $37m, up from $27m two years ago.

In this latest bull market run. tanker companies continue to report record earnings. Most recently Teekay has declared record profits, with first quarter net income of $189m. up 253% from $53.6m in the corresponding period last year.

The company explained that high spot rates were partly the reason for the better figures, whilst the integration of Navion was another key factor.

Meanwhile a senior executive at tanker company Stelmar declared a bullish view of the future. Peter Goodfel low.

chief executive, told Bloomberg news that current strong demand in both the East and West, led by China and the US, is very unusual and provided the company with a good opportunity to reposition ships profitably. Historically, it was not easy to find profitable cargoes to reposition ships for repairs in the east, Goodfellow said, but now Asian growth was far outstripping expansion in the US, he said.

OMI meanwhile has reported its best ever quarter and anticipates that the strong tanker market will last for several years.

The first quarter profit of $56.41 m was up from $25.73m one year earlier and was not only the company's best ever figure but was actually more than annual income in all but two of the years since 1984. According to OMI figures, the world's tanker fleet comprised 295.3m dwt at the end of March. The orderbook of just over 83m dwt represented 28.1% of the fleet.

Read Steel, Ship Prices Soar as Tankers Stay Firm in Pdf, Flash or Html5 edition of May 2004 Maritime Reporter

Other stories from May 2004 issue

Content

- Fincantieri Delivers Westerdam page: 10

- "World's Largest" Heavy Lift Ship Enters Service page: 10

- Damen Delivers Pair of Tugs page: 10

- Not Just Another Dam Ship page: 12

- Welsh Towing Company Growth Continues page: 14

- Gladding-Hearn Starts Construction of New I neat Vessel page: 15

- Despite 11% Increase, Hempel Disappoints page: 15

- Grimaldi-Naples Receives GM Award page: 16

- Schlueter Promoted to VP page: 17

- Misplacing the Place of Refuge page: 20

- Schottel Broadens Electric Propulsion Options page: 26

- CIMAC Congress Set for Kyoto page: 29

- Waterjets for a Difficult Design Task page: 30

- New Shaft Seal from Ocean Venture Seals page: 31

- Gas Turbines: Keeping Fresh With Innovation page: 32

- MAN B&W Diesel Debuts the New S65ME-C page: 33

- Thordon COMPAC Finds Success in FSV page: 33

- Wartsila to Power Australian FPSO page: 34

- VSP: Same Power, 9% More Bollard Pull page: 35

- The New MTU 2000 CR Marine Engines page: 36

- Converting and Repowering One Very Big Ship page: 38

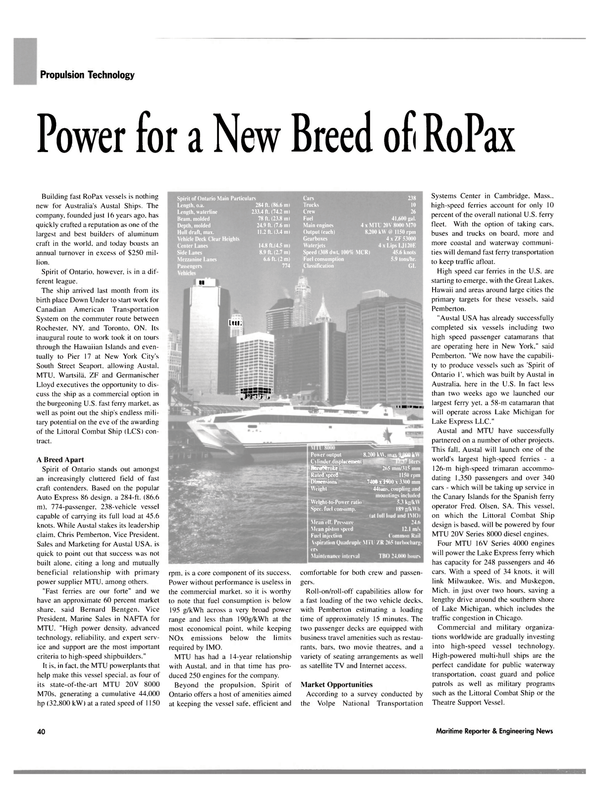

- Power for a New Breed of RoPax page: 40

- ZF Helps to Harness Spirit of Ontario's Power page: 41

- Greece Poised for Posidonia 2004 page: 42

- Leif Hoegh Records Strong First Quarter page: 43

- BV Launches LNG CAP page: 43

- Steel, Ship Prices Soar as Tankers Stay Firm page: 44

- Ice Class & Large Ships Pose New Challenges page: 44

- Royal Caribbean Stays Current with C-MAP CM-93/3 ECs page: 46

- JRC Proposes Integrated Nautical Safety System page: 46

- C-Map's RTU and the Ending of the Paper Trail page: 47

- AutoChief C20 Reports Good Market Penetration page: 48

- Vision FT IBS page: 48

- Research Winches for R/V Maria S. Merian page: 52

- Konecranes Giving Port Efficiency a Lift page: 52

- Chinese Yard Logs Strong Month page: 55

- Fuel Oil Separation Takes Center Stage page: 56

- Security of Ports and Vessels: A New Approach page: 60