THE OUTLOOK FOR U.S. NAVY SHIPBUILDING AND SHIP REPAIR

Status of U.S. Navy Ship Modernization and Maintenance NAVY BUDGET The proposed Navy budget is $101.7 billion in FY 1990 and $105.1 billion in FY 1991. This would represent a three to four percent increase over current spending. Described below are Navy's plans and budget for major program activities over the next several years.

SHIPBUILDING Navy has requested $10.4 billion in FY 1990 to fund construction of 20 new ships and two major conversions.

The amount of $9.8 billion is requested in FY 1991 to build 14 ships—including two follow ships in the SSN 21 attack submarine program.

Outlays for ship construction will grow from $8.9 billion in FY 1988 to $10.9 billion in FY 1991. This growth occurs despite the fact that obligational authority is much lower in FY 1991 than FY 1988.

Shown in Exhibit 1 is the breakdown of the shipbuilding budget request for the FY 1988-1991 period.

Exhibit 2 shows the projected program over the next five years.

A major change in the future program has been the deletion of three SSN 688 submarines originally planned for FY 1991 and 1992.

There had been criticism of Navy's plan to overlap construction of the SSN 21 and SSN 688. The current plan is now to end the SSN 688 program in FY 1990. In FY 1991 Navy plans to order two SSN 21's and maintain a construction rate of three per year thereafter.

Navy plans to build DDG 51 Aegis destroyers at the rate of five per year over the next five years. This program is a target for budget cutting— most likely by stretch-out— building fewer ships per year over a longer period.

Other changes from last year's plan include a change in timing for several programs—including the AOE fast combat support ship, LHD amphibious assault ship and TAGOS survelliance ship. Three MCM mine countermeasure ships have been added for FY 1990. (See MR, 3/89 issue page 25 for a full report on 'The Navy—A $35-Billion Annual Market') SHIP REPAIR U.S. Navy ship maintenance and modernization continues to be a ma- lion in FY 1990 and $5.7 billion in FY 1991 to maintain and modernize ships in the active forces. This compares with $5.0 billion this year and $4.5 billion in FY 1988. Details are shown in Exhibit 3.

While total funding is projected to increase, the number of maintenance availabilities is expected to fall. As shown in Exhibit 4, the number of active fleet overhauls is projected to drop to 15 in FY 1990, 12 in FY 1991. This is below the current year, where 25 overhauls are scheduled.

Short term availabilities will also fall over the next two years. The number projected for FY 1991—128 short term availabilities—is lower than the current level of activity.

Distorting the funding trend is a conventional carrier overhaul in FY 1990 and the complex overhaul of the nuclear carrier U.S.S. Enterprise (CVN-65) in FY 1991. These two overhauls consume a substantial portion of the ship maintenance budget—and the work is earmarked for performance in specific shipyards.

Naval Reserve Fleet Funding of $208 million is requested in each of the next two years for maintenance and moderni- zation of ships in the Navy reserve fleet. This compares with $199.0 million in FY 1989 and $157.0 million in FY 1988. Details are provided in Exhibit 5.

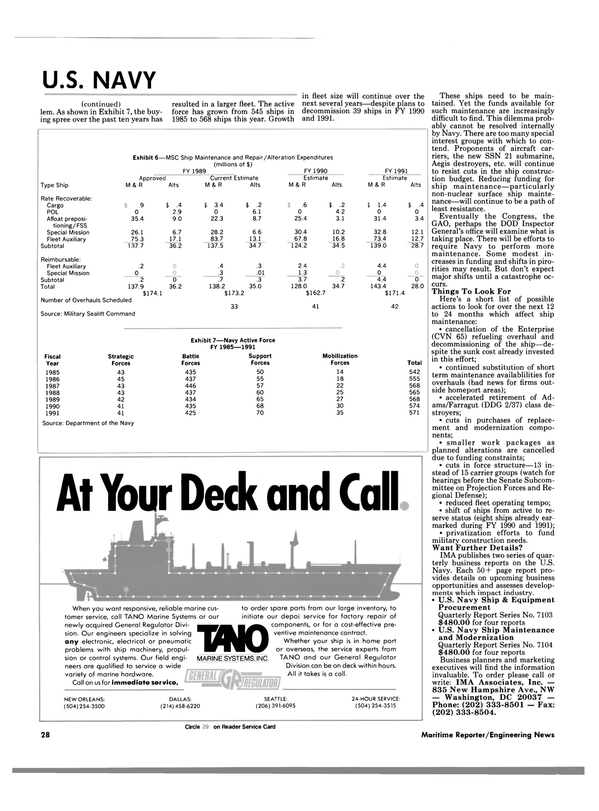

Military Sealift Command Spending for MSC ship maintenance and modernization is projected to be $162.7 million in FY 1990 and $171.4 million in FY 1991.

A total of 41 and 42 overhauls are scheduled in FY 1990 and 1991 respectively. Details are shown in Exhibit 6.

Deferred Maintenance Occurring The Navy is obviously deferring maintenance and modernization to stay within budget constraints. In its presentation to Congress, Navy indicates budget pressures will create a ship overhaul backlog of three ships in FY 1989, four ships in FY 1990 and five ships in FY 1991.

Navy also indicates "funding constraints force the deferral of short term availabilities." Our data suggest a far worse situation occurring. By our count, the Navy had planned to perform 27 overhauls and over 200 short term availabilities in FY 1990. Assuming these figures are accurate, the number of ship overhauls has been cut by 44 percent in FY 1990 and short term availabilities in FY 1990. Assuming these figures are accurate, the number of ship overhauls has been cut by 44 percent in FY 1990 and short term availabilities have been cut by more than one quarter.

Long Term Implications The Navy is facing a serious prob- lem. As shown in Exhibit 7, the buying spree over the past ten years has resulted in a larger fleet. The active force has grown from 545 ships in 1985 to 568 ships this year. Growth in fleet size will continue over the next several years—despite plans to decommission 39 ships in FY 1990 and 1991.

These ships need to be maintained.

Yet the funds available for such maintenance are increasingly difficult to find. This dilemma probably cannot be resolved internally by Navy. There are too many special interest groups with which to contend.

Proponents of aircraft carriers, the new SSN 21 submarine, Aegis destroyers, etc. will continue to resist cuts in the ship construction budget. Reducing funding for ship maintenance—particularly non-nuclear surface ship maintenance— will continue to be a path of least resistance.

Eventually the Congress, the GAO, perhaps the DOD Inspector General's office will examine what is taking place. There will be efforts to require Navy to perform more maintenance. Some modest increases in funding and shifts in pirorities may result. But don't expect major shifts until a catastrophe occurs.

Things To Look For Here's a short list of possible actions to look for over the next 12 to 24 months which affect ship maintenance: • cancellation of the Enterprise (CVN 65) refueling overhaul and decommissioning of the ship—despite the sunk cost already invested in this effort; • continued substitution of short term maintenance availablilities for overhauls (bad news for firms outside homeport areas); • accelerated retirement of Adams/ Farragut (DDG 2/37) class destroyers; • cuts in purchases of replacement and modernization components; • smaller work packages as planned alterations are cancelled due to funding constraints; • cuts in force structure—13 instead of 15 carrier groups (watch for hearings before the Senate Subcommittee on Projection Forces and Regional Defense); • reduced fleet operating tempo; • shift of ships from active to reserve status (eight ships already earmarked during FY 1990 and 1991); • privatization efforts to fund military construction needs.

Want Further Details?

IMA publishes two series of quarterly business reports on the U.S.

Navy. Each 50+ page report provides details on upcoming business opportunities and assesses developments which impact industry.

• U.S. Navy Ship & Equipment Procurement Quarterly Report Series No. 7103 $480.00 for four reports • U.S. Navy Ship Maintenance and Modernization Quarterly Report Series No. 7104 $480.00 for four reports Business planners and marketing executives will find the information invaluable. To order please call or write: IMA Associates, Inc. — 835 New Hampshire Ave., NW — Washington, DC 20037 — Phone: (202) 333-8501 - Fax: (202) 333-8504.

Read THE OUTLOOK FOR U.S. NAVY SHIPBUILDING AND SHIP REPAIR in Pdf, Flash or Html5 edition of June 1989 Maritime Reporter

Other stories from June 1989 issue

Content

- Campbell Launches Super Pacific Class Tuna Purse Seiner page: 5

- NMEA Schedules 1989 Annual Meeting page: 5

- Allied-Signal Offers Free Literature On Spectra High-Performance Ropes page: 6

- ASTICAN Offers 18-Page Color Brochure On Facilities And Capabilities page: 6

- Navy Commissions Guided Missile Cruiser page: 8

- Navy Christens ACS At Tampa Shipyards page: 9

- Trinity Marine Group Delivers Detroit Diesel-Powered Ferry To Texas Transportation Department page: 12

- Great Lakes Energy Named Supplier Of DDC 6 - 1 1 0 Engine Parts page: 13

- Avondale Christens USS Rushmore, Fourth In Series Of LSDs For USN page: 14

- Wartsila—Turku Shipyard Delivers New Baltic Cruiser 'Athena' page: 14

- 1989 International Maritime Exposition To Expand Its Exhibitor Emphasis page: 15

- Second Tanker With One-Man Bridge Delivered By B & W page: 15

- Marine Gears Introduces 'TR' Series Marine Clutches page: 16

- Marine & Offshore Offers Free Color Brochure On ABB Variable AC Drives page: 18

- SPD Awarded Contract For Integrated Electric Drive System page: 19

- Phillips Cartner Elects Principals And Adds New Staff Members page: 20

- American Marine Completes Refurbishment Of Bulk Cement Carrier page: 20

- MMFG Announces Major Changes For Duradek Fiberglass Grating page: 22

- THE OUTLOOK FOR U.S. NAVY SHIPBUILDING AND SHIP REPAIR page: 24

- REVIEW OF SHIPBUILDING AND REPAIR AT U.S. YARDS page: 28

- A WO In 1989: Tested By Drought And Ready To Face New Challenges page: 42

- REVIEW AND OUTLOOK page: 44

- WORLD SHIPBUILDING page: 46

- ABS PLAYS VITAL ROLE IN OUTSTANDING SAFETY RECORD OF THE GROWING PASSENGER SUB INDUSTRY page: 50

- Fetterolf's Specialty Assembly Valve Eliminates Field-Welding page: 70

- Integrated Bridge Control System Offered By Valmet —Literatured Available page: 70

- AWSC Elects New Officers At Tampa, Fla., Meeting page: 87

- Mackay Communications Wins U.S. N a v y AGOR-23 Electronics Package page: 88

- FMC Issues N e w Brochure On Dynetor Connectors page: 88

- Watercom Installs Payphones On Steamboat page: 89

- Morgan Crane Moves To New Facility In Santa Ana, Calif. page: 91

- SeaTrac Offers Free Color Brochures On Roll-Damping Systems page: 91

- Alpha Diesel Introduces Four-Stroke Medium-Speed Diesel Engine Series page: 92

- Drew Ameroid Helps Shipowners Control High Costs Of Low-Cost Fuels page: 93

- USS Cowpens Launched At BIW for U.S. Navy page: 94

- USNS 'Dutton' Emergency Drydocking At Dakar Marine page: 95

- DOT Regulations Prohibit Dumping Plastics At Sea page: 96

- Seacoast Announces 'J.I.T.' Inventory Management And Distribution System page: 97

- Furuno Offers New Radar For Workboats, Smaller Vessels page: 98

- New Lifesaving Equipment Rules Proposed For Large Commercial Ships page: 98

- Fast Wave-Piercing Catamaran Ferry Ordered For Cross-Channel Route page: 99

- PRMMI Appoints Hayes Port Manager In Baltimore page: 101

- Elliott White Gill Thrusters Offer Excellent Maneuverability With Complete Control page: 101

- North American Shipyard Delivers Research Vessel 'Edwin Link' To Harbor Branch Oceanographic page: 101

- S/S Rotterdam To Undergo $10-Million Refurbishment At Northwest Marine page: 102

- U.K.'s Kelvin Hughes To Get Queen's Award For Export Achievement page: 102

- L&C Designs And Installs Dehumidification And Monitoring System For General Cargo Ship page: 107

- VL Logistics Opens New Corporate Headquarters page: 108

- SeaArk Marine Appoints Two New Managers page: 109

- FBM Marine Introduces New Generation Of Fast Catamarans, Ferry Craft And Crewboats page: 112

- Moss Point Delivers Two Cummins-Powered Towboats To Hashemite Kingdom Of Jordan page: 112

- Wartsila Diesel Repowering SeaEscape's Cruise Vessel M / V Scandinavian Sun page: 113

- NMHS Offers Literature On Emergency Medical/ Trauma Consultation page: 113